|

|

|

|

#1

|

|||

|

|||

|

http://news.msn.com/us/house-votes-t...hutdown-closer

republicans, by a wide margin, concede that a govt shutdown would be horrible for the country and the economy. but politics triumphs over what's good for the people. i see a trillion dollar coin in the offing. i wonder if the debt ceiling can removed by exective order....

__________________

Books serve to show a man that those original thoughts of his aren't very new at all. Abraham Lincoln |

|

#2

|

|||

|

|||

|

and i just saw a story about a conscience clause added by repubs to the spending bill. outrageous.

keep in mind that erectile dysfunction pills, vacuum suction devices, penile implants and vasectomies are covered by insurers and medicare....yes, medicare covers vacuum suction devices. one viagra or cialis is about 15 a pill. one MONTH of bc pills is about $15.

__________________

Books serve to show a man that those original thoughts of his aren't very new at all. Abraham Lincoln |

|

#3

|

||||

|

||||

|

Too bad the Senate decided to take Sunday off - I guess the gov shutdown is no big deal

__________________

We've Gone Delirious |

|

#4

|

||||

|

||||

|

GOP committing political suicide. Markets set to crater will get people to notice.

|

|

#5

|

||||

|

||||

|

Quote:

__________________

Gentlemen! We're burning daylight! Riders up! -Bill Murray |

|

#6

|

||||

|

||||

|

|

#7

|

||||

|

||||

__________________

Gentlemen! We're burning daylight! Riders up! -Bill Murray |

|

#8

|

|||

|

|||

|

http://www.slate.com/blogs/moneybox/...oncession.html

'But the debt ceiling isn't some pet Obama administration priority. There is a gap between the spending that Congress has instructed Treasury to undertake and the taxes that Congress has authorized Treasury to collect. Authority to borrow the money to fill the gap is necessary to legally dot the i-s and cross the t-s. Granting it does not authorize any new spending and failing to grant it does not cut spending.' and here is a link to an article discussing the 'conscience clause' repubs worked up: http://www.slate.com/blogs/xx_factor...employers.html

__________________

Books serve to show a man that those original thoughts of his aren't very new at all. Abraham Lincoln |

|

#9

|

|||

|

|||

|

and this, on what happens if the ceiling isn't raised:

http://www.slate.com/blogs/moneybox/..._mean_you.html 'Looking around the Web today, most grassroots conservatives and a frightening number of Republican members of Congress seem to be under the misapprehension that raising the debt ceiling increases government spending or that failing to raise it decreases government spending. Neither is true. I don't think anyone really knows what will happen if the debt ceiling isn't raised, but a reduction in government spending is not one of the possible consequences. There are two kinds of government spending—mandatory and discretionary—and neither of them will be cut by a single penny by a refusal to hike the debt ceiling.' and at the end: 'Spending is determined by the laws that have already been passed, and if you want to spend less money you need to change those laws.'

__________________

Books serve to show a man that those original thoughts of his aren't very new at all. Abraham Lincoln |

|

#10

|

||||

|

||||

|

Quote:

At least it does for individuals and businesses. And, if there is no effect on spending as said above, then why is everyone pushing for a raise of the debt ceiling? |

|

#11

|

||||

|

||||

|

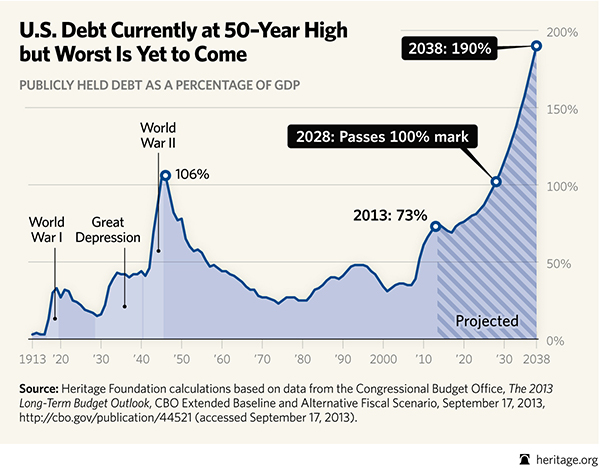

Unless we plan on taxing every good and service 100% I think GDP represents nothing but potential tax money.

The situation is far worse when considering total tax revenues, expected at $2.7 trillion this year vs. annual budget $3.7 trillion with a total debt just over $20 trillion. To put it in real numbers imagine going to a bank for a loan to pay bills, making $27K/yr. after taxes with $37K/yr. in expenses and owing 200K in credit card bills, including cards taken out in your children's and grandchildren's names. It would be nice for everyone to have health insurance whether supplemented or not. It would also be nice if everyone had a house and a yard. But in the real world the money's not there and like everyone living in the real world we need to cut back and make (tax) more. Since neither party seems willing to, Dems cut and GOP tax, I suggest forming a dueling league and holding 20 Dem v. GOP events with the best of seven duels. |

|

#12

|

|||

|

|||

|

Quote:

if we want to lower our debt, we need to re-do the budget, or raise taxes. the debt is what the govt uses to finance what taxes don't cover. regardless of party in control of the white house, the debt ceiling becomes a political football. when bush was president, the repubs had no issue with raising the debt ceiling, and dems fought it-such as obama, when a senator. of course, now the shoe's on the other foot. but it's a ridiculous stance to take, as the very congresspeople now fighting over this debt ceiling are the same ones who control the purse strings, the spending, the budgets, which aren't in line, haven't been in line, and require the govt to borrow in the first place!! it would be like your wife and you buying a house, two cars, etc, and then refusing to finance it-you want to pay in cash, but you don't have the cash. but you agreed to buy all those items. so, you fork over your cash, and then what? that's where the govt will find itself if the ceiling isn't raised, again, as it has been raised however many times over the years. in a nutshell, congress passes tax and spending bills that make a budget deficit necessary and they are now refusing to allow the borrowing to finance that deficit-a deficit congress created! if they want to stay under the current debt ceiling, they need to change their tax and spending bills.

__________________

Books serve to show a man that those original thoughts of his aren't very new at all. Abraham Lincoln |

|

#13

|

||||

|

||||

|

Quote:

You'll never see DC work harder. |

|

#14

|

|||

|

|||

|

and here, from will saletan (one i don't always agree with, but always read)

http://www.slate.com/articles/news_a...le_ground.html Republicans pretend there’s lots of precedent for this sort of “compromise.” They point to 17 previous shutdowns (helpfully outlined by Dylan Matthews in the Washington Post), most of which were resolved by concessions. But when you examine these cases, the claims of resemblance evaporate. The present shutdown threat is nothing like those cases. For the first time, a single party, controlling a single house of Congress—despite having lost the popular vote for that chamber by more than a million ballots in the most recent election—is refusing to fund the government unless the other chamber and the president agree to suspend previously enacted legislation. Sorry, Republicans. Nothing in the Constitution authorizes a single house of Congress to retroactively veto U.S. law by refusing to fund the rest of the government. The manner in which you’re attempting this blackmail—on party-line votes, engineered by the party that lost the popular vote—doesn’t help. The Senate and the president have no legal or moral obligation to humor your demands. Do your job, or we’ll throw you out.

__________________

Books serve to show a man that those original thoughts of his aren't very new at all. Abraham Lincoln |

|

#15

|

||||

|

||||

|

I say we vote to reduce the debt ceiling.

|

|

#16

|

||||

|

||||

|

great bumper sticker.

disastrous fiscal policy. |

|

#17

|

||||

|

||||

|

Kinda like this one:

|

|

#18

|

|||

|

|||

|

and i thank you for reading what i posted.

your comment only shows that you misunderstand the subject.

__________________

Books serve to show a man that those original thoughts of his aren't very new at all. Abraham Lincoln |

|

#19

|

|||

|

|||

|

http://www.slate.com/articles/busine..._limit_is.html

Normally the way things work is that the Treasury Department cuts the checks Congress has told it to cut, collects the taxes Congress has told it to collect, and borrows to cover the difference. But the statutory debt ceiling also instructs Treasury not to borrow more than a certain amount of money. When we hit the debt ceiling on Oct. 17, Treasury will lack the legal authority to borrow any more money to close the gap between spending and tax revenue. At that point, there are basically three options. One is President Obama could decide that the governmentís legal obligation to spend (and certain elements of the 14th Amendment) trump the statutory debt ceiling, and just order the Treasury to sell more bonds. The second option is Obama could instruct the Treasury to pay some of the governmentís bills and just not pay the rest. The third option is to pay nobody. All three of these options face the same basic problem of seeming to be illegal. (The second one also faces the problem that Treasury says it lacks the logistical capacity to do it.) The general consensus is that the third option would, among other things, provoke a global financial crisis by causing a default on U.S. treasury bondsóbonds that are meant to be the safest asset in the financial system. The first option may avoid this fate, but perhaps not. Itís difficult to imagine financial markets would be undisturbed by the prospect. And in general, simply nobody knows what anyone should do about anything if the debt ceiling is breached. Unlike with the shutdown, there is no overriding OMB guidance. There are no rules to spell out essential versus nonessential services. Officially, at least, thereís no contingency planning at all. Itís just a kind of terrifying world of uncertainty. And thatís the big difference between these two events. There hasnít been a government shutdown in a while but they were common in the 1970s and 1980s. Theyíre a big deal in Washington, D.C. because federal employees donít get paid when they happen. But as long as it doesnít last too long, itíll be fine. A debt ceiling breach, by contrast, is completely unprecedented. Thereís no guarantee that itíll lead to a worldwide financial panic and a massive global depression, but thereís honestly no guarantee that it wonít. Nobody knows what will happen, and you should find that prospect terrifying.

__________________

Books serve to show a man that those original thoughts of his aren't very new at all. Abraham Lincoln |

|

#20

|

||||

|

||||

|

Much Ado About Nothing.

|