|

factcheck on ACA taxes

no, it's not the largest tax increase ever. but it's still a hefty one:

http://factcheck.org/2012/07/biggest...se-in-history/ Q: Is the new health care law “the biggest tax increase in history?” A: In raw dollars, perhaps. But several tax increases just since 1968 were larger as percentages of the economy, or in inflation-adjusted dollars. FULL QUESTION Will “Obamacare” be the largest tax hike in US history? FULL ANSWER Several readers have asked us about this since Rush Limbaugh made a hugely exaggerated claim that the new health care law is “the biggest tax increase in the history of the world.” We’re not sure Limbaugh meant his statement to be taken seriously; He offered no figures or citations to back up what he said. But other critics of the law have made similar claims. The increase is certainly large. So let’s take a look at how the taxes and fees that finance “Obamacare” stack up against earlier increases. A Big Increase There’s no question that the package of taxes and other revenue-raisers that the law contains constitute a large increase. The most recent estimate from the nonpartisan Joint Committee on Taxation puts the total for more than a dozen different tax increases and other “revenue-related provisions” at $675 billion between now and 2022. And that’s not counting the effect of penalty payments by individuals who refuse to take out health insurance (estimated by the nonpartisan Congressional Budget Office to be $54 billion over the same period. |

This isn't a tax increase. It's a penalty for not purchasing insurance, which will be levied on less than 1% of US citizens.

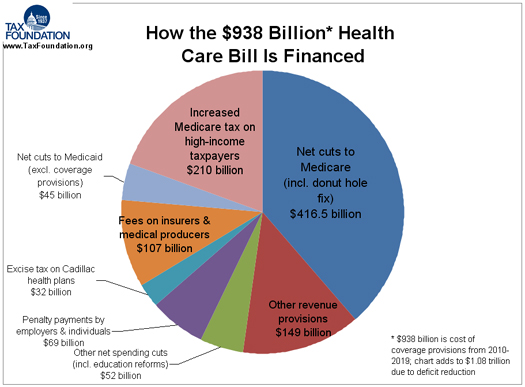

---------------- Who "pays" for Obamacare? Still not a massive "tax increase". Even if you are one of the people in the country who make over $250,000 a year and thus will have an additional medicare tax on that portion of your income (which now has nothing) 99% of American people will pay nothing to help finance the Affordable Care Act  Update: Per the suggestion of Washington Post writer Ezra Klein, we have posted more detail pertaining to what is in some of the larger categories in the pie chart above. Main Components in Net Cuts to Medicare ($416.5 billion) Reductions in annual updates to Medicare FFS payment rates = $196 billion cut Medicare Advantage rates based upon fee-for-service rates = $136 billion cut Medicare Part D "donut hole" fix = $42.6 billion increase Payment Adjustments for Home Health Care = $39.7 billion cut Medicare Disproportionate Share Hospital (DSH) Payments = $22.1 billion cut Revision to the Medicare Improvement Fund = $20.7 billion cut Reducing Part D Premium Subsidy for High-Income Beneficiaries = $10.7 billion cut Interactions between Medicare programs = $29.1 billion cut Main Components in Other Provisions ($149 billion) Associated effects of coverage provisions on revenues = $46 billion Exclusion of unprocessed fuels from the cellulosic biofuel producer credit = $23.6 billion Require information reporting on payments to corporations = $17.1 billion Raise 7.5% AGI floor on medical expenses deduction to 10% = $15.2 billion Limitations to the use of HSAs, MSAs, FSAs, etc. = $19.4 billion Other Net Spending Cuts ($52 billion) Education reforms = $19 billion cut, which is the difference between approximately $58 billion in spending reductions via reform of the student loan program and approximately $39 billion in greater spending on higher education programs, most notably Pell Grants Community Living Assistance Services and Supports = $70 billion in cuts Category is netted lower by increases in other health programs such as public health programs and spending on community health centers |

and i just read this, about the money to be made if your doctor dispenses meds to you directly:

http://www.nytimes.com/2012/07/12/bu...l?pagewanted=1 unreal. |

Quote:

|

| All times are GMT -5. The time now is 09:46 AM. |

Powered by vBulletin® Version 3.6.8

Copyright ©2000 - 2026, Jelsoft Enterprises Ltd.